Since 2015, pensions in the Russian Federation have been calculated in a new way. Now the size of the pension and the right to it depend on the number of points. Let's take a closer look.

What does a pension consist of?

The insurance pension (formerly called labor pension) is calculated according to the formula:

number of points * cost of one point.

The cost changes annually and is approved by Government Decree. Those citizens who have earned at least thirty points during their working life have the right to pension provision. The total pension includes the insurance part and a fixed payment (previously the basic part). The size of the fixed payment is also approved at the state level.

That is, only points need to be calculated. And their number depends on the salary.

Conversion of pension rights acquired before 2002

- experience until 2002;

- average monthly earnings (taken from 2000-2001 or any 60 months before 2002);

- experience until 1991

The first indicator is taken into account in the form of an experience coefficient. It cannot exceed 0.75.

- The man began working in January 1976. Total experience – 26 years. The seniority coefficient is 0.55 + 0.01 * (26-25), or 0.56.

- For a woman under the same conditions, the calculation looks like this: 0.55 + 0.01 * (26-20), or 0.61.

- If the work experience is less than 20 years (for women) or 25 years (for men), then the length of service coefficient is 0.55.

The calculation of average earnings for a pension is made through the “earnings ratio”. This is the ratio of the average monthly salary of a citizen to the average monthly salary in the state for the same time period.

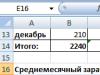

The citizen submitted to the Pension Fund a salary certificate for 60 months from 05/01/1986 to 04/30/1991.

Average earnings when calculating a pension are calculated using the formula:

The average monthly salary in the country is 230.1.

Earnings ratio: 1.2. The law established the maximum threshold for this coefficient: 1.2. Therefore, when assessing pension rights, not 1.38, but 1.2 is taken into account.

How to determine the size of a pension based on average earnings (earnings ratio):

- The estimated pension for citizens with a length of service coefficient over 0.55 is calculated as the product of the length of service coefficient, the average monthly salary coefficient and 1671 rubles. If the resulting value is less than 660 rubles, then you need to subtract 450 rubles. The amount of 1671 rubles is the SWP - the average monthly salary in Russia for the period 07/01/01-09/30/01 (constant value);

- If the length of service coefficient is 0.55, then a formula of the form is applied: (0.55 * average monthly salary coefficient * 1671 - 450) * (experience until 2002 / 25). This is for men. For women, the second multiplier is (experience until 2002/20). If the calculated value turns out to be less than 660 rubles, then for men - 210 * (experience until 2002/25), for women - 210 * (experience until 2002/20).

The woman retired in 2015. Total experience – 35 years. Until 2002 – 22 years. This is more than twenty years. This means that the formula for calculating the experience coefficient is as follows:

Let's assume the earnings ratio is 1.2. Since the length of service coefficient is greater than 0.55, the formula for the calculated pension looks like this:

The woman got a job in 1980. Consequently, she has work experience until 1991. When taking into account valorization, it will be necessary to add 10% to the calculated pension and 1% for each full year of work until 1991.

She worked for 11 years from 1980 to 1991.

Pension capital is indexed annually. As of December 31, 2014, the index value was 5.6148. Let's find pension rights in rubles for the period before 2002, taking into account bonuses and indexation:

Let's convert it into points. To do this you need to divide by 64.1.

This is part of a citizen's pension rights until 2002. When calculating a pension, the number of points will be multiplied by the value of 1 point accepted on the calculation date.

Calculation of the IPC for the period from 2002 to 2015.

- It is necessary to find the amount of transferred insurance premiums for a given period.

- The insurance part of the labor pension is calculated as of December 31, 2014: the amount of contributions / 228 (survival period).

- We find the IPK: insurance part / 64.1.

In other words: the insurance part of a labor pension is a pension calculated according to the “old” rules “minus” the funded part and a fixed additional payment (set by the state).

Pension points since 2015

Calculated for each year of work experience. For the calculation, the salary is taken, on which insurance premiums are calculated. Contributions to the FS – 22%. 16% goes to the formation of the insurance (10%) and funded (6%) part of the old-age labor pension. Let's assume that a citizen does not want to form a funded part separately.

To find the number of points earned in 2015, you need to:

IPCs for different periods are added up and multiplied by the point value accepted at the date of retirement.

This is a simplified calculation without taking into account increasing factors, interrupted service, etc.

State regulation in Russia, in accordance with the constitution, is of a social nature; for these purposes, a minimum wage standard was introduced - the Minimum Wage in Russia. The concept of “basic value” corresponds to the concept of “minimum wage” or abbreviated as minimum wage.

What is the minimum wage in Russia

The minimum wage (abbreviated as MROT) is a set minimum wage per hour, day or month (year) that an employer can (must) pay its employee and for which the employee can legally sell his labor.

- The minimum wage can be established legislatively and informally, for example, by signing an industry agreement between a trade union and a consolidated employer (tariff agreement).

- Although the minimum amount is applied in many countries, there is no clear consensus on the benefits and harm that such a minimum brings.

The minimum wage is regulated by Federal Law dated June 19, 2000 No. 82-FZ “On the minimum wage” and Art. 133 of the Labor Code of the Russian Federation. At the same time, regulation is carried out at the federal and regional levels.

By whom and how is it installed?

In accordance with the Federal Law of June 19, 2000 No. 82-FZ “On the Minimum Wage,” the minimum wage in Russia at the federal level is established only by the Government.

According to Art. 133.1 of the Labor Code of the Russian Federation, the minimum wage at the regional level is determined by concluding tripartite agreements between representatives of trade unions, employers and government bodies of the constituent entities.

The legislation does not set a specific date. The minimum wage is changed according to a special resolution of the Government of the Russian Federation.

What is provided

The minimum wage established by federal law is ensured by:

- organizations financed from the federal budget - at the expense of the federal budget, extra-budgetary funds, as well as funds received from business and other income-generating activities;

- organizations financed from the budgets of the constituent entities of the Russian Federation - at the expense of the budgets of the constituent entities of the Russian Federation, extra-budgetary funds, as well as funds received from entrepreneurial and other income-generating activities;

- organizations financed from local budgets - at the expense of local budgets, extra-budgetary funds, as well as funds received from business and other income-generating activities;

- other employers - at their own expense.

Controlled by

Compliance with minimum wage standards is monitored by:

- Ministry of Labor and Social Protection

- Financial authorities

- State Labor Inspectorate

- Prosecutor's Office bodies.

Position of trade unions

The Federation of Independent Trade Unions of the Russian Federation believes

« The fact that the minimum wage should be calculated not lower than the subsistence level is unconditional. But what is the living wage? The living wage that is being calculated now is calculated using a flawed methodology that was introduced in 1991 by the first Gaidar government as a crisis methodology for use within six months. 20 years have passed and it is still in use. In fact, this is the level of physiological survival. It cannot be called a real minimum wage«.

Regional minimum wage

In view of the different standards of living between the regions of Russia, Article 133.1 of the Labor Code of the Russian Federation provides for the right of regional authorities to set their own minimum.

How and by whom it is installed in the region

The minimum wage at the regional level is established by agreement of three parties: the government of the constituent entity of the Russian Federation, the association of trade unions and the association of employers (the union of industrialists and entrepreneurs).

All employers in the region automatically become parties to such an agreement if they do not send a written reasoned refusal within 30 days from the date of its official publication in the regional media.

You can find out the specific minimum wage in the state labor inspectorate for the region or in regional media on the Internet.

Combining the minimum wage and subsistence level

Vladimir Putin signed the law of December 28, 2017 No. 421-FZ on increasing the minimum wage to the subsistence level from January 1, 2019, and in 2018 proposed to accelerate the integration of indicators from May 11, 2018.

The Ministry of Labor and Social Protection approved that the Federal minimum wage in Russia from May 1, 2018 will be set at the level of the subsistence level of the working population in Russia as a whole for the second quarter of the previous year.

What is it used for?

The minimum amount used to regulate wages in the Russian Federation, as well as to determine the amount of benefits for temporary disability. This indicator answers the question of how much and what minimum wage an employer should pay an employee in Russia, with the exception of St. Petersburg and Moscow (set separately).

Pay sick leave and maternity benefits based on the minimum wage in four cases:

- the employee has no earnings in the pay period;

- average earnings are less than the minimum wage;

- the employee's insurance period is less than six months;

- the employee violated sick leave without a valid reason.

The minimum wage is also used to determine the amount of taxes, fees, fines and other payments, which are calculated in accordance with the legislation of the Russian Federation depending on the minimum amount.

Employers do not have the right to pay employees a monthly salary in an amount less than the established amount. True, if an employee works part-time or part-time, then he can receive an amount per month that is less than the minimum wage, and there are no legislative obstacles here.

Minimum wages by year in Russia

An indicator used to regulate wages and determine the amount of benefits for temporary disability, pregnancy and childbirth, as well as for other purposes of compulsory social insurance.

|

The period from which |

Minimum amount |

Normative act, |

|---|---|---|

| from January 1, 2019 | 11 280,00 | the federal law 12/28/2017 No. 421-FZ |

| from May 1, 2018 | 11 163,00 | the federal law dated 03/07/2018 No. 41-FZ |

| 9 489,00 | the federal law dated December 28, 2017 No. 421-FZ |

|

| 7 800,00 | the federal law dated December 19, 2016 No. 460-FZ |

|

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

|

Art. 1 Federal Law |

||

Wages for the assessment of pension rights acquired before January 1, 2002

So, for insured persons who have pension rights acquired before January 1, 2002, to calculate the amount of the insurance part of the old-age labor pension, the calculated pension capital (PC1) is used, in the formula for determining which the average salary of the insured person is used (ZR).

Earning periods used to calculate pensions when converting pension rights

The average monthly earnings of the insured person (AP) can be presented for the following periods of work or service (except for compulsory military service) that occurred before January 1, 2002:

1) for 2000-2001;

2) for any 60 consecutive months (earnings for 60 months may also include earnings for the period 2000-2001);

3) for persons who, as of December 31, 2001, already had a labor pension established, the amount of average monthly earnings from which the established pension is calculated may be taken into account.

ü For example, the Law of the Russian Federation of April 3, 1992 allowed in 1993 (at the request of the pensioner) the average monthly earnings for the assignment or recalculation of a pension to be calculated for the last 12 months of work (service) before applying for a pension or its recalculation. This earnings could be accepted for work no earlier than from January 1, 1992 to December 30, 1993 inclusive. If a pensioner was assigned a pension as of December 31, 2001 using this rule, then earnings (ZR) in the conversion formula can be taken for the specified 12-month period.

The following are excluded from the number of months for which average monthly earnings are calculated (at the request of the person applying for a pension) and may be replaced by other periods immediately preceding or following them:

- incomplete months of work due to its start or termination not from the first day of the month

- months, including incomplete months, in which, for objective reasons, there could be a reduction in wages: leave in connection with caring for a child under three years of age, being on disability, receiving compensation for damage caused by injury or other damage to health, caring for a disabled person of group I, a disabled child or an elderly person who needs outside care based on the conclusion of a medical institution.

In law enforcement practice, situations arise when, in the individual (personalized) accounting information for the period 2000-2001, which is less than 24 months, the insured person’s entire period of work activity falls only on the specified period. In this case, calculation of average monthly earnings (AM) is possible based on the months actually worked.

Example. The citizen's 16-month labor activity occurred only in the period 2000-2001. In this case, his earnings for the specified period can be divided into the months actually worked, that is, 16 months (ZR 2000-2001 = 16 months/16 months).

If a citizen has a labor activity not only in the period 2000-2001, but also for other periods, the calculation of earnings for 2000-2001. carried out by dividing available earnings by 24 months (ZR2000-2001 = 16 months/24 months).

Amounts included in earnings

In accordance with paragraph 9 of Art. 30 of the Law on Labor Pensions (as amended), when assessing pension rights acquired before January 1, 2002, the previously existing procedure for calculating and confirming the earnings of the insured person is applied (i.e. established by the Law of the Russian Federation of November 20, 1990 No. 340-1 “On State pensions in the Russian Federation"). Therefore, when determining payments that are included in earnings to determine the amount of salary, it is necessary to refer to Article 100 of the Law of the Russian Federation of November 20, 1990 No. 340-1. In accordance with it, earnings include:

1. All types of payments (income) received in connection with the performance of work (official duties) provided for in Article 89 of Law No. 340-1, for which insurance pension contributions were calculated (work as a worker, employee (including work for hire up to establishment of Soviet power and abroad), a member of a collective farm or other cooperative organization; other work in which the worker, not being a worker or employee, was subject to state social insurance).

The issue of including certain amounts in earnings is decided taking into account the lists of payments for which, in accordance with the legislation in force during a particular period of work of a citizen, insurance contributions to the Pension Fund were not charged.

In order to understand what amounts (and to what extent) were subject to insurance pension contributions, and for which payments contributions were not accrued, you can use the following documents:

1) The procedure for payment of insurance contributions by employers and citizens to the Pension Fund of the Russian Federation (Russia), approved. Resolution of the Supreme Council of the Russian Federation dated December 27, 1991 No. 2122-1. It was in effect until the second part of the Tax Code of the Russian Federation came into force on January 1, 2001.

ü Amounts paid for basic and additional vacations are indicated in the month in which the corresponding periods of basic and additional vacations fall.

Resolution of the State Labor Committee of the USSR and the Secretariat of the All-Union Central Council of Trade Unions of September 3, 1990 No. 358/16-28 “On approval of the List of types of wages and other payments for which insurance contributions are not charged and which are not taken into account when determining average monthly earnings for calculating pensions and benefits for the state social insurance";

Decrees of the Government of the Russian Federation dated February 19, 1996 No. 153 and dated May 7, 1997 No. 546;

Letter of the Pension Fund of the Russian Federation dated August 16, 1996 No. YUL-12-11/5927-IN “On payments to trade union activists”;

Information letter of the Supreme Arbitration Court of the Russian Federation dated July 12, 2000 No. 55 “Review of the practice of resolving disputes by arbitration courts related to the payment of insurance contributions to the Pension Fund of the Russian Federation.”

In accordance with the explanations of the Pension Fund of the Russian Federation, when individual entrepreneurs who paid a single tax on imputed income made payments to employees before 01/01/2001, the calculation of the average monthly earnings of employees is carried out based on the amounts of payments from which insurance contributions to the Pension Fund were withheld from them in at the rate of 1 percent. (payments accrued in favor of specified citizens for all reasons, regardless of sources of financing).

If this category of entrepreneurs makes payments to employees during the period from 01.01.2001 to 31.12.2001 inclusive, the average monthly earnings of employees is determined based on the decision of the entrepreneur, who, at his discretion, distributed the amount of imputed income, on which a single tax on imputed income was paid, between hired workers.

2) from January 1, 2001 to December 31, 2001 inclusive - Chapter 24 of the second part of the Tax Code of the Russian Federation (it introduced a unified social tax (contribution), part of which are mandatory insurance contributions to the Pension Fund).

Article 238 of the Tax Code of the Russian Federation defines amounts that are not subject to taxation (and, therefore, not taken into account as part of earnings for the purpose of assessing pension rights acquired before January 1, 2002), and Article 239 defines tax benefits for various categories of single social tax payers. Together, these norms, when deciding on the possibility of taking into account certain amounts in earnings (ZR), should be applied taking into account the position of the Pension Fund, outlined by it in Letter dated April 18, 2001 No. KA-09-18/3295 “On payment of the single social tax (contribution )" (“...exemption of employers from paying contributions to state social insurance relates to the procedure for paying the unified social tax (contribution) and cannot violate the rights of employees to compulsory social insurance...").

2. In addition to payments related to the performance of work, for which insurance pension contributions were calculated, earnings for calculating the pension (PP) include:

- monetary allowance for military personnel and persons equal to them in pension provision, paid for the period of service specified in Art. 90 of Law No. 340-1 (service in the Armed Forces of the Russian Federation and other military formations created in accordance with the legislation of the Russian Federation, the United Armed Forces of the CIS, the Armed Forces of the USSR, in the internal affairs bodies, foreign intelligence, counterintelligence, ministries and departments in which the law military service is provided, etc.);

- temporary disability benefits.

Amounts paid for temporary disability are indicated in the month in which the corresponding periods of temporary disability occur.

Despite the fact that Law No. 340-1 stipulates that the scholarship paid for the period of study is included in the earnings, taking into account which the pension is calculated, the authorities of the Pension Fund of the Russian Federation in their practice proceed from the fact that, since in accordance with the Law on labor pensions (clause 4 of article 30), periods of study are not included in the total length of service used when assessing pension rights acquired before January 1, 2002, and the scholarship cannot be used in calculating the employee’s earnings (E) for converting pension rights.

In law enforcement practice, the question arises about the possibility of taking into account maternity benefits as part of earnings (E) when assessing pension rights as of January 1, 2002. The law enforcer, represented by the Pension Fund of the Russian Federation, gives a negative answer to this question, which does not seem entirely logical, given his point of view (and justification for it) on the question of including a scholarship in the composition of the RF (see the previous paragraph), as well as the position of the Constitutional Court of the Russian Federation . The fact is that on March 20, 1997 (the date of amendments to Law No. 340-1), maternity benefits were included in earnings for calculating pensions. The Law on Labor Pensions (subclause 4, clause 4, article 30) provides for the inclusion of a period of incapacity for work due to pregnancy and childbirth in the total length of service for calculating the length of service coefficient (SC) in the formula for converting pension rights. Based on this, we can conclude that if the period for which the employee’s earnings are considered fell on the period of time before March 20, 1997, maternity benefits can be included in the amount of earnings; if - after the specified date, then this benefit is not taken into account in earnings, and the period of maternity leave is not excluded or replaced by other months.

For persons who, as of December 31, 2001, already had a labor pension for old age, disability or loss of a breadwinner, to determine the estimated size of the labor pension, at their request, the amount of their average monthly earnings from which the established pension was calculated can be taken into account.

Confirmation and proof of earnings

In accordance with the List of documents required to establish a labor pension, approved by Resolution of the Ministry of Labor of Russia and the Pension Fund of the Russian Federation dated February 27, 2002 No. 16/19pa, documents on average monthly earnings (AZ) must be attached to the application of a citizen applying for an old-age labor pension. ) for 2000 - 2001 or for any 60 consecutive months during his working life until January 1, 2002.

If the time for which the average monthly earnings are taken to calculate the pension falls on the period after the employee’s registration in the compulsory pension insurance system in accordance with Federal Law No. 27-FZ of April 1, 1996 “On individual (personalized) registration in the compulsory pension insurance system ", then the earnings are confirmed by an extract from the individual personal account of the insured person, compiled on the basis of individual (personalized) accounting information. If - for the period before registration - certificates issued in the prescribed manner by the employer or state (municipal) bodies on the basis of primary accounting documents.

In the event of liquidation of an employer or state (municipal) body or termination of their activities for other reasons, these certificates are issued by the legal successor, a higher body or archival organizations.

In cases provided for by law, the following are also accepted for calculating pensions:

- certificates of payment under civil contracts, the subject of which is the performance of work and provision of services, with a note on the payment of insurance premiums;

- pay books or certificates issued by trade union bodies, with the participation of which agreements on the work of individuals with individual citizens were concluded, indicating the earnings of workers and employees of the relevant profession and qualifications employed at state enterprises and in public service organizations;

- copies of personal accounts issued by archival organizations.

What is individual (personalized) accounting, when employees were registered in it as insured - see the section “Explaining to citizens their pension rights. Preventive measures to eliminate violations of pension rights.”

In practice, there are often situations when citizens cannot provide any documents to determine their average monthly earnings before registering in the state pension insurance system due to the fact that the primary documents on earnings were lost by the employer, were not transferred to legal successors or were not deposited in archival organizations in case of liquidation of the employer.

In a joint information letter dated November 27, 2001 No. 8389-YuL/LCh-06-27/9704B, the Ministry of Labor of the Russian Federation and the Pension Fund of the Russian Federation recommended that bodies providing pension provision consider each case of loss in state and municipal bodies and organizations in a commission manner with the involvement of representatives of executive authorities of constituent entities of the Russian Federation, local governments, employers, trade union bodies, labor authorities and territorial bodies of the Pension Fund of the Russian Federation.

If it is established that the employee has suffered damage, expressed in the impossibility of assigning or recalculating a pension from the most profitable option of average monthly earnings, and this damage is subject to compensation by a person who, by virtue of his official duties, must be liable for obligations arising from causing harm, the affected persons must be given appropriate recommendations for going to court. If it is impossible to determine the cause of harm (for example, in cases of natural disasters), the Pension Fund of Russia bodies may accept documents that indirectly confirm the actual earnings of the employee at this particular enterprise: registration cards of party members and party cards, registration cards of trade union members and union cards, registration cards of members Komsomol and Komsomol tickets, pay books (pay slips), orders and other documents from which one can draw a conclusion about the individual nature of the employee’s earnings.

As can be seen from the text of the letter from the Ministry of Labor of Russia and the Pension Fund of the Russian Federation, this procedure for confirming earnings can be used in very limited cases (according to the organizational and legal form of the employer - a legal entity (only state and municipal bodies and organizations) and the reasons for the loss of necessary documents (natural disasters)). Therefore, in most cases, insured persons have to apply to the courts to confirm their earnings.

Currently, difficulties have arisen regarding the possibility of confirming (in court) an employee’s earnings with testimony.

Before January 1, 2010, a uniform judicial practice was developed that allowed the use of witnesses when other methods of proving the amount of wages had been exhausted. Thus, in accordance with the position of the Supreme Court of the Russian Federation, expressed in the Review of judicial practice of the Supreme Court of the Russian Federation for the first quarter of 2005, in court proceedings, receiving wages in a certain amount (based on which the average monthly earnings are calculated, necessary to determine the insurance part of the pension in case of assessment of pension rights) in case of loss of primary accounting documents can be confirmed by any other evidence, including testimony.

On January 1, 2010, amendments introduced by Federal Law No. 213-FZ of July 24, 2009 to the Law on Labor Pensions came into force. In particular, paragraph 3 of Art. 30 now contains an indication that the average monthly earnings are not supported by testimony. At the same time, the Law on Labor Pensions retained the rule (clause 12, Article 30) on the possibility of applying the procedure for confirming earnings, which was established and was in force before the Law on Labor Pensions came into force, i.e. until January 1, 2002.

On the one hand, the possibility of confirming in court the amount of an employee’s salary (ZR in the formula for converting pension rights) with testimony currently follows from the norm of paragraph 12 of Art. 30 of the Law on Labor Pensions (which guarantees compliance with the principle of legal certainty in pension legislation, which the Constitutional Court of the Russian Federation has repeatedly pointed out in its decisions), as well as from the reasoning of the Supreme Court from its previous decisions.

Based on the arguments previously used by the Supreme Court of the Russian Federation, as well as on the fact that the pension legislation in force until January 1, 2002 (RF Law of November 20, 1990 No. 340-1 “On State Pensions in the Russian Federation”) did not contain a ban on the use of witness testimony when confirming the amount of earnings, it would be logical to assume that problems with establishing the amount of wages used for converting pension rights acquired before January 1, 2002, based on testimony, should not arise.

However, answering the question about the possibility of courts using witness testimony when establishing a legal fact in similar legal relations (when establishing the nature of work that gives the right to early assignment of a pension) in the Review of Legislation and Judicial Practice for the second quarter of 2010, the Supreme Court referred to the prohibition established new edition (from 01/01/2010) of the Law on Labor Pensions. The same conclusion was later duplicated by the Supreme Court of the Russian Federation and in the Resolution of the Plenum of December 11, 2012 No. 30.

Unfortunately, it remains unclear whether the Supreme Court assessed the relationship between the rule prohibiting the use of witness testimony and the rule of paragraph 12 of Art. 30 of the Law on Labor Pensions, and whether the Supreme Court considers the rule prohibiting the use of witness testimony to apply to the past (i.e. before it came into force on January 1, 2010) - to confirm earnings before January 1, 2002, which is used for conversion of pension rights.

The fact of receiving wages in a certain amount, if necessary for the assignment of a pension, can be confirmed by the court in a special proceeding (in accordance with Article 264 of the Civil Procedure Code of the Russian Federation). However, if a dispute arises about the right to calculate a pension from the most profitable option of average monthly earnings, such a dispute must be resolved through a lawsuit (in accordance with the requirements of Part 3 of Article 263 of the Code of Civil Procedure of the Russian Federation, which excludes the possibility of considering the case in a special proceeding in the event of a dispute about law).

In court, an employee can confirm the amount of earnings by any means not prohibited by law and without reference to the period when the earnings took place (before or after the employee’s registration in the accounting system).

Example: we calculate the earnings ratio (ZR/ZP) in the formula for converting pension rights

The citizen chose the option of using earnings for the 60-month period of his working activity. He provided the body providing his pension with a certificate of earnings (in rubles) for the period 05/01/1985 – 04/30/1990 for calculating the salary:

|

years months |

1985 |

1986 |

1987 |

1988 |

1989 |

1990 |

|

January |

||||||

|

February |

||||||

|

March |

||||||

|

April |

||||||

|

May |

||||||

|

June |

||||||

|

July |

||||||

|

August |

||||||

|

September |

||||||

|

October |

||||||

|

November |

||||||

|

December |

||||||

|

TOTAL, rub. |

2240 |

2980 |

3760 |

3630 |

4430 |

1700 |

Average monthly salary of an employee (ZR) = (2240+2980+3760+3630+4430+1700)/60 months. = =18740 / 60 months. = 312 rubles

We take data on the average salary in the country for the same period (ZP) from the Table below.

Table 8. Average monthly salary in the country for converting pension rights into estimated pension capital

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average monthly salary in the country (ZP) for the same period (05/01/1985 – 04/30/1990) =

= (199.2*8 +206.1*12 + 214.4*12 + 233.2*12 + 263*12 + 303*4) / 60 months. =

= (1593.6+2473.2+2572.8+2798.4+3156+1212)/60 months. = 230.1 ruble

Thus, the earnings ratio (ZR/ZP) will be equal to: ZR/ZP = 312 / 230.1 = 1.356.

However, given that according to the Law it cannot be higher than 1.2, the value of 1.2 will be applied in the formula for converting pension rights.

________________________________________

The payment of insurance contributions to the Pension Fund of the Russian Federation before January 1, 2002 is equivalent to the payment of state social insurance contributions, the unified social tax (contribution) and the unified tax on imputed income for certain types of activities.

They were introduced by laws on the tariffs of contributions to state social extra-budgetary funds for the corresponding calendar year.

Explanation of the Ministry of Labor and Social Development of the Russian Federation dated August 18, 2000 No. 8 “On the procedure for preparing documents on average monthly earnings for the purpose of providing pensions, taking into account the amounts paid for temporary disability, as well as basic and additional leaves.”

Resolution of the Constitutional Court of the Russian Federation of January 29, 2004 No. 2-P.

Approved by decisions of the Presidium of the Supreme Court of the Russian Federation dated May 4, 11 and 18, 2005, see also the Ruling of the Supreme Court of the Russian Federation dated February 19, 2001 in case No. 59-B01-1k.

Art. 60 of the Civil Procedure Code of the Russian Federation provides: the circumstances of the case, which, in accordance with the law, must and can be confirmed by certain means of proof, cannot be confirmed by any other evidence.

In particular, in the Decrees of November 5, 2002 No. 320-O and of October 3, 2006 No. 471-O, Decrees of January 29, 2004 No. 2-P and of June 3, 2004 No. 11-P.

See reference 45.

Approved by a resolution of the Presidium of the Supreme Court of the Russian Federation dated September 15, 2010.

The sum of average monthly salaries in the country in the country for May-December 1985.

The minimum wage (minimum wage) at the state level is approved by the relevant federal law. The minimum wage is valid throughout Russia and cannot be less than the subsistence level of able-bodied citizens for the 2nd quarter of the previous year for the purpose of calculating wages (Article 1 of the Law “On Minimum Wages” dated June 19, 2000 No. 82-FZ). In other words, an employee who has actually worked the standard amount of time established by the labor agreement cannot receive a salary less than the established minimum wage. If an employer pays a salary less than the minimum wage, he faces a fine under clause 6 of Art. 5.27 Code of Administrative Offenses:

- from 10,000 to 20,000 rub. on officials;

- from 30,000 to 50,000 rub. for legal entities;

- from 1,000 to 5,000 rubles. for individual entrepreneurs operating without forming a legal entity.

If previously neither the social nor financial departments of the Russian Federation, nor parliamentarians could establish compliance of the minimum wage with the subsistence level, then in March 2018 the President of the Russian Federation signed Law No. 41-FZ dated 03/07/2018, the norms of which determined that from 05/01/2018 the minimum wage will be equal to the subsistence level of the working-age population for the 2nd quarter of last year.

Thus The minimum wage as of May 1, 2018 was 11,163 rubles. The Ministry of Labor approved the cost of living for the 2nd quarter of 2018 in the amount of 11,280 rubles. And since the cost of living for the 2nd quarter of 2018 is equal to the minimum wage for 2019, then from 01/01/2019 the value of the federal minimum wage is 11,280 rubles.

The same applies to the minimum wage for 2020. It is equal to the cost of living for the 2nd quarter of 2019, which is 12,130 rubles. (see order of the Ministry of Labor dated 08/09/2019 No. 561n)

The minimum wage regulates not only wages, but also the amount of benefits (including maternity benefits), and until the end of 2017, the amount of contributions for individual entrepreneurs. Let's look at how the minimum wage changed over the period from 2013 to 2018.

Minimum wage for 2015-2018 in Russia

The minimum wage in 2015 was 5,965 rubles. (Article 1 of the Law of the Russian Federation dated December 1, 2014 No. 408-FZ).

The minimum wage 2016, introduced on January 1, 2016, amounted to 6,204 rubles. (Article 1 of the Law of the Russian Federation dated December 14, 2015 No. 376-FZ). From 07/01/2016 it was increased to 7,500 rubles. (Article 1 of the Law of the Russian Federation dated June 2, 2016 No. 164-FZ).

Since the beginning of 2017, the value of the minimum wage has not changed, remaining equal to the value of 7,500 rubles, effective from 07/01/2016. However, from July 1, 2017, the minimum wage increased to 7,800 rubles. (Article 1 of the Law of the Russian Federation dated December 19, 2016 No. 460-FZ).

Since January 2018, the minimum wage has increased to 9,489 rubles. From 05/01/2018, as mentioned above, 11,163 rubles.

Read about the role of the minimum wage in setting wages in the material "St. 135 Labor Code of the Russian Federation: questions and answers" .

What changes did the minimum wage undergone in 2015-2016 in comparison with the subsistence level?

The minimum wage for the years 2015 and 2016 did not increase as significantly as the cost of living increased. Therefore, the value of the ratio between them decreased, amounting to:

- 57% of the cost of living in 2015;

- 63% of the cost of living at the beginning of 2016;

- 76% of the cost of living in the 3rd quarter of 2016.

What is the minimum wage in 2014

As noted above in accordance with Art. 133 of the Labor Code, the minimum wage in 2014 (as in all other years) should not have been less than the subsistence minimum established for able-bodied persons in Russia. However, in 2014, the cost of living established for an able-bodied person increased from 8,283 to 8,885 rubles. At the same time, the minimum wage in 2014 was only 5,554 rubles.

What changes in the minimum wage occurred in 2013

The minimum wage in 2013 was 5,205 rubles, which is 39.4 times more than at the beginning of 2000. The minimum wage in 2013 in Russia was equal to 68.2% of the subsistence level for able-bodied persons for the same period. At the same time, in 2000, the minimum wage was 9.33 times less than the subsistence level for able-bodied persons.

Such excesses are explained by the fact that until 2010 the minimum wage was used not only to regulate the level of wages, but also to determine the amount of various socially significant benefits. In 2013-2014, the ratio between the minimum wage and the subsistence level fluctuates at around 67-68%, without demonstrating significant positive dynamics.

Limit base for calculating contributions to the Pension Fund in 2014-2018 and the minimum wage

The size of the minimum wage in 2014 began to be used when calculating the amount of insurance premiums for individual entrepreneurs, and this procedure was applied until the end of 2017, despite the fact that insurance premiums from 2017 came under the control of the tax authorities and began to be subject to the provisions of the relevant chapter of the Tax Code of the Russian Federation.

The procedure for calculating contributions paid by individual entrepreneurs to the funds implied that the minimum wage established at the beginning of the tax period was multiplied by 12 months and by the insurance rate of the state fund (PFR, MHIF). If the income received by the entrepreneur for the year exceeds the amount of 300,000 rubles. from the amount of this excess, he had to pay another 1% (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation).

Read more about insurance premiums and other payments paid by individual entrepreneurs in this article .

Table of minimum wages by year

The minimum wage table is also convenient because you can see not only the value of the indicator, but also track its dynamics.

|

The minimum wage for 2013 is 5,205 rubles. (approved December 2012) |

|

The minimum wage in 2014 is 5,554 rubles. (approved December 2013) |

|

The minimum wage in 2015 is 5,965 rubles. (approved December 2014) |

|

|

|

|

From 01/01/2019 - 11,280 rub. |

|

From 01.01.2020 - 12,130 rub. |

How much is the minimum wage in 2019 in the largest regions

In accordance with Art. 133.1 of the Labor Code, the governments of the constituent entities of the Federation can sign regional agreements with associations of trade unions and employers, which establish the local level of the minimum wage.

IMPORTANT! The regional minimum wage cannot be lower than the minimum wage established by federal legislation.

If a subject has established its own minimum wage, then the salary of an employee who has worked the standard amount of time cannot be lower than the regional minimum wage indicator.

Let's consider the minimum wage values in 2019 in the regions of the Russian Federation (as of September 1, 2019):

- The minimum wage for Moscow is 19,351 rubles.

- In St. Petersburg, the minimum wage is 18,000 rubles.

- The maximum value of the minimum wage in the Central District was recorded in the Moscow region at the level of 14,200 rubles.

- The maximum value of the minimum wage in the Southern Federal District was recorded at 12,030 rubles. in the Krasnodar region.

- In almost all other constituent entities of the Russian Federation, the 2019 minimum wage is equal to the federal average of 11,280 rubles. In a number of regions, regional coefficients need to be taken into account.

Results

The minimum wage for 2020 has been increased to 12,130 rubles. In 2019 it is 11,280 rubles. Since May 2018, the minimum wage has become equal to the subsistence level of the working-age population for the 2nd quarter of 2017 and amounted to 11,163 rubles. Regions also have the right to set the minimum wage, but it cannot be lower than the federal figure.

Hello, dear editors! I have a question about the size of my pension. At the beginning of September this year I celebrated my 60th birthday. I was assigned a pension of 9264.60 rubles. With 40 years of work experience, I expected more. That's why I continue to work now. No matter how I tried to figure out for myself whether my pension was calculated correctly, I still did not understand where this amount came from. My data is as follows: as of 01/01/2002, my experience was 32 full years, including 21 years before 01/01/1991. Average monthly salary for 2000 - 2001 amounted to 2795.60 rubles. according to an extract from my personal account with the Pension Fund (calculated at the reception by a specialist from the pension department). Insurance contributions from 01/01/2002 until the day the pension was assigned (I also found this amount in the statement) - 383,705 rubles. Please explain to me how such a pension was calculated for me. A. I. Seregin.

WHAT IS THE CALCULATION FORMULA?

Let me remind you that starting from January 1, 2010, the old-age labor pension (denoted by the symbol P) for citizens who began working before January 1, 2002, is determined by the formula: P = FBI + SCH1 + CH2 + .SV.

FBI is a fixed basic pension amount, it is set by the state in a fixed amount.

SCH1 is the insurance part of the pension, which is calculated from length of service and earnings for the period of work until 2002.

SCH2 - the insurance part of the pension, which is calculated from the amounts of the employer's insurance contributions for the period of work from 2002 to the date of assignment of the pension.

SV - the amount of valorization, determined as a percentage of SP1. This percentage depends on the full years of service before 1991.

At the last indexation of labor pensions from February 1, 2011, the FBI old-age labor pension was set at 2963.07 rubles.

Now let’s calculate the remaining terms in the calculation formula.

SC = 0.55 (for 25 years of work for a man before 2002) + 0.07 (for 7 years of work beyond 25 years) = 0.62.

Now we calculate the ratio of the average monthly salary of the reader to the average salary in the country for the same period.

The average salary in Russia (ZP) for 2000 and 2001, according to statistics, amounted to 1494.5 rubles.

It turns out that the ratio of earnings (ZR) to the average salary in the country (ZP) for the same period is:

Salary: Salary = 2795.60 rub.: 1494.50 rub. = 1.87.

As you can see, Seryogin’s salary ratio is favorable - higher than the maximum possible ratio of 1.2 provided for pensions for work under normal conditions.

An exception is established by law only for “northerners”. For them it can be higher - from 1.4 to 1.9 (depending on the type of work in which region of the North the pension is awarded).

Art. 30 of the Federal Law “On Labor Pensions in the Russian Federation”

It should be recalled that the Government of the Russian Federation, for calculating pension capital, on January 1, 2002, established the average monthly salary in the Russian Federation (the same for everyone). It is 1671 rubles.

The size of SCH1 as of 01/01/2002 is calculated using the formula:

SCH1 = SK x (ZR:ZP) x 1671 rub. - 450 rub.

450 rub. - the size of the basic part of the pension as of January 1, 2002 (it is also the same for all pensioners).

Based on this, SCH1 as of 01/01/2002 = (0.62x1.2x1671 rubles) - 450 rubles. = 793.22 rub.

To do this, we index (increase) the amount of SCH1 received as of January 1, 2002 by all indexation coefficients of pension capital from 2002 to 2011.

SCH1 on the date of pension assignment = 793.22 rubles. x 4.2542 = 3374.52 rub.

The third component of the pension is SCH2. To calculate it, the insurance premiums accrued by the employer on the date of pension assignment must be divided by the number of “months of survival”. From the letter we know that its author’s amount of accrued insurance premiums, taking into account indexations, as of the date of appointment amounted to 383,705 rubles.

The size of the expected payment period (T) depends on the year the retirement pension was assigned.

For the purpose of pensions in 2011, it is set at 224 months. Thus, the size of the question author’s SB2 was:

SC2 = RUB 383,705: 204 months. = 1880.91 rub.

Table of average wages in the RSFSR in 1970 - 90.

AMOUNT OF VALORIZATION

Knowing SCH1, we can now determine another component of the pension - the valorization amount (SV).

First, we calculate the percentage of valorization of reader Seryogin’s pension: 10% (for having experience before 2002) + 21% (for 21 years of experience before 1991) = 31% (0, 31).

SV = 3374.52 rub. (size SCh1) x 0.31 = 1046.10 rub.

SUMMARIZE

We add up the amounts received and get the size of the pension of our reader A.I. Seregin:

P = 2963.07 + 3374.52 + 1880.91 + 1046.10 = 9264.60 rub.

IF IN 2000-2001 YOU DID NOT HAVE A SALARY...

It may turn out that 2000-2001. for some reason you did not work or your average salary during this period was less than 1,794 rubles. (the average salary in the country over these years is 1494.50 rubles x 1.2). Then you will have to submit a salary certificate for any 60 months before January 1, 2002.

The pension amount takes into account the ratio of the pensioner’s salary to the national average for the same period.

You can determine the profitable period yourself by comparing the data from the certificate with the statistical average (see tables 1 and 2).

Let's say your 60-month salary certificate was issued for the period of work from July 1, 1979 to June 30, 1984. We add up all the accrued wages from the salary certificate and divide by 60 months.

After such simple calculations, it turns out, for example, that your average salary over these years was 198.50 rubles.

Now we determine the average salary in the country for the same period from the table.

Average salary in the Russian Federation from the table for the period from 07/01/1979 to 06/30/1984 = (168.4 rubles x 6 months + 174.0 rubles x 12 months +178.3 x 12 + 184, 0 x 12 + 188.3 x 12 + 193.2 rub. x b month): 60 months. = 181.08 rub.

We calculate the ratio of earnings that will be taken into account in the pension:

198.50:181.08 = 1.096 (and the maximum according to the law is 1.2). What to do in such a situation? Try to find a more profitable option for earning money over another 5 years.

Average salary table in the Russian Federation

to calculate the amount of pension from 1991 to 2001.

|

Cash |

Thousand rub. |

|||||||||||

|

Years |

||||||||||||

|

January |

||||||||||||

|

February |

||||||||||||

|

March |

||||||||||||

|

April |

||||||||||||

|

June |

||||||||||||